[ad_1]

Unprecedented EV gross sales and a scarcity of funding to maintain tempo with them have put Oregon EV and plug-in hybrid rebates on maintain.

The Oregon Division of Environmental High quality (DEQ) not too long ago introduced that it’s quickly suspending the state’s Clear Car Rebate Program because of projections exhibiting that will probably be oversubscribed by late spring. April 30 is the final day to buy or lease a car that may qualify for a rebate.

2023 Nissan Leaf

This system is funded yearly from Oregon’s Car Privilege Tax, which covers the rebates themselves in addition to secondary prices like administration and group outreach, in accordance with a DEQ press launch, including that some funds had been carried over from final 12 months. Based mostly on the present quantity of EV gross sales, the company expects the present $15.5 million put aside for rebates to expire within the subsequent few months.

The state’s Clear Car Rebate Program was launched in 2018, providing rebates of $750 to $2,500 for qualifying new EVs, plug-in hybrids, or electrical bikes with a base MSRP underneath $50,000. A Cost Forward element all these making as much as 400% of the federal poverty guideline qualify for a rebate of as much as $5,000, which means that lower-income consumers can rise up to a $7,500 state rebate on high of no matter federal rebate they’re in a position to declare.

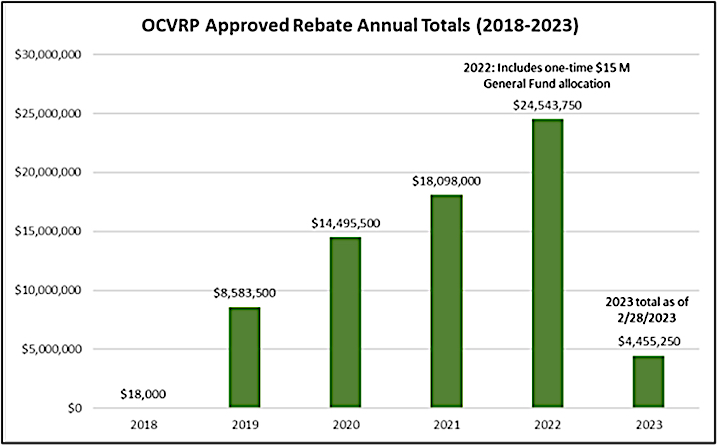

The Oregon program has issued greater than $71 million in rebates since its launch.

2023 Kia Niro Plug-In Hybrid

Oregon residents who buy or lease an eligible EV, plug-in hybrid, or electrical bike should apply for a rebate, and the Oregon DEQ has launched an obtainable funding web page to trace how a lot cash is left for 2023 rebates. As soon as funding is depleted, purposes will likely be positioned on a ready listing pending renewed funding for 2024. There is no such thing as a ready listing for automobiles bought or leased after April 30; these automobiles won’t obtain state rebates, the DEQ famous.

EVs not lined by the state program might nonetheless qualify for federal tax credit, the DEQ famous, however that can be not simple due to new guidelines enacted underneath the Inflation Discount Act (IRA). The push main as much as the rule change may very well be exacerbating Oregon’s funding drawback.

Based on the electrical car advocacy group Forth, there’s some hope for the rebate to proceed, if the Oregon Legislature can move a state invoice that may applicable one other $30 million to this system, persevering with it to 2025.

Oregon annual EV rebate totals

“Oregon’s electrical automotive rebate is a key instrument for combating local weather change, defending households from unpredictable gas prices and constructing vitality independence,” stated Forth’s govt director Jeff Allen. “This can be a horrible time to make it extra complicated and costlier for Oregonians to decide on a clear electrical automotive.”

EV gross sales have been front-loaded this 12 months as a result of Inner Income Service (IRS) steering will successfully lower the tax credit score for some U.S.-built EVs to $3,750 or much less when it is launched. The IRS has promised that it will fast-track the brand new guidelines, however that is resulted in a wierd run on purchases and claims for many who need the complete federal quantity whereas they’ll get it.

This is not the primary time a state EV incentive program has run low on funds because of sturdy demand. California made its EV incentives smaller in 2021, partly due to funding, whereas additionally decreasing MSRP and earnings caps.

The U.S. West Coast is now aligned, as a part of California’s Superior Clear Vehicles rules and what’s successfully a ban on non-plug-in ICE automobiles by 2035, with each Oregon and Washington pledging to hitch California. Within the brief time period, although, it appears Oregon will not be capable to use incentives as a instrument to spur additional EV adoption.

–with reporting from Bengt Halvorson

[ad_2]