[ad_1]

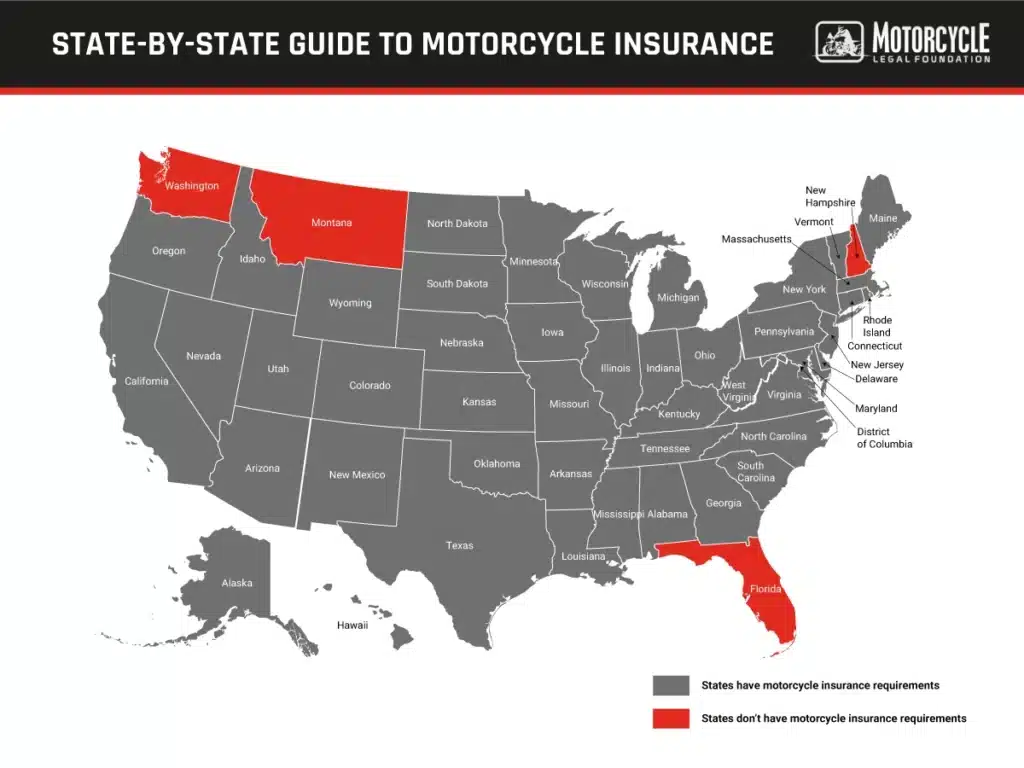

Solely 4 states, Florida, Montana, New Hampshire, and Washington, wouldn’t have necessary motorbike insurance coverage necessities. The opposite 46 states and the District of Columbia require that you just a minimum of have bodily damage and property injury protection to register and trip a bike. The reality is that carrying motorbike insurance coverage is a good suggestion no matter the place you trip.

If somebody is injured or incurs property injury in an accident that you just brought on, a bike insurance coverage coverage pays for an legal professional to defend you and pays claims as much as the protection limits. Even for those who stay in a state that doesn’t have motorbike insurance coverage necessities, buying a coverage gives peace of thoughts.

Holding monitor of motorbike insurance coverage necessities might be difficult, notably in case your rides take you away throughout state borders. This information provides you the newest details about insurance coverage necessities in every state and explains the various kinds of necessary and elective coverages chances are you’ll want to take into account buying. Simply needless to say legal guidelines change, so it’s smart to test a state’s motorcar division to find out if there have been any current adjustments in its motorbike insurance coverage necessities.

Want Bike Insurance coverage?

Take pleasure in your trip whereas feeling protected with the most effective insurance coverage protection.

Bike Insurance coverage Fundamentals

Bike insurance coverage and car insurance coverage are comparable. You pay a premium to an insurance coverage firm in alternate for it issuing an insurance coverage coverage with coverages providing monetary safety in case of an accident or different mishap.

You select the scope of the safety by deciding on from protection choices provided by the insurer. For instance, the generally provided varieties of coverages out there in a bike insurance coverage coverage embrace the next:

- Legal responsibility Insurance coverage: When an accident you trigger when using a bike leads to private accidents to a different individual or injury to their property, legal responsibility insurance coverage pays to defend towards claims made towards you and pay them as much as the protection limits. Bodily damage and property injury, the 2 parts of legal responsibility insurance coverage, are the coverages required in states with necessary motorbike insurance coverage.

- Uninsured and Underinsured Motorist Protection: Once you undergo accidents in an accident brought on by the negligence of one other motorist who doesn’t have legal responsibility insurance coverage or doesn’t have sufficient insurance coverage, you possibly can file a declare towards your insurance coverage firm underneath the uninsured motorist protection and underinsured motorist protection. Some states, together with Maryland, Missouri, and Wisconsin, require that you’ve this protection as a part of your motorbike insurance coverage coverage.

- Collision Protection: Collision is an elective protection you add to your insurance coverage coverage that pays for repairing or changing your motorbike broken in a crash, no matter who was at fault.

- Complete Protection: Complete pays for injury to your motorbike or theft brought on by occasions aside from collisions, together with hearth, theft, vandalism, climate, and comparable circumstances.

You resolve on the quantity of insurance coverage to buy. Simply needless to say the extra insurance coverage protection you get, the better the price of the coverage. For those who stay in a state with minimal insurance coverage necessities, you should purchase greater than the necessary minimal protection.

The price of motorbike insurance coverage is determined by the kind of protection you choose and the quantity of protection. Insurance coverage corporations additionally consider components they know from analyzing accident and declare knowledge have an effect on the price of a bike insurance coverage coverage, together with the next:

- Your age and using expertise: Riders between the ages of 15 and 20 and people 65 and older have increased charges of deadly crashes.

- Sort of motorbike: A bike with a small engine and the newest security options is much less of an accident danger than a bike with a strong motor that doesn’t have ABS and different security options.

- Your driving document: A historical past of accidents and visitors violations most likely means you’ll pay extra for insurance coverage than somebody with a clear driving document.

- The place you reside: In accordance with the federal authorities, extra deadly motorbike crashes happen in city areas than in rural communities, so for those who stay in a metropolis, count on to pay extra for insurance coverage.

Acquiring value quotes from a number of corporations is a wonderful technique to get the most effective price for motorbike insurance coverage.

Is Bike Insurance coverage Required?

Florida, Montana, New Hampshire, and Washington are the one states the place you possibly can register a bike and trip with out insurance coverage and never be in violation of the legislation. Florida, which doesn’t require proof of insurance coverage to register or trip a bike, has a monetary duty legislation.

The monetary duty legislation means motorbike riders concerned in an accident in Florida should have the monetary potential to pay claims made towards them for property injury and bodily accidents ensuing from an accident the place they have been at fault. The simplest method for an individual to fulfill the monetary duty requirement is with a legal responsibility insurance coverage coverage with a minimum of $10,000 in bodily damage protection for one individual injured or killed in a crash and $20,000 of protection per accident when two or extra persons are killed or injured.

Including property injury protection to the coverage within the minimal quantity of $10,000 ensures compliance with Florida legislation and avoids a three-year suspension of an individual’s driver’s license. The statute lets you self-insure by acquiring a certificates of monetary duty from the state after proving you possibly can pay claims made towards you.

The motorbike insurance coverage necessities within the remaining 46 states and the District of Columbia have one factor in widespread. Every of them requires legal responsibility insurance coverage and property injury protection, however they differ within the quantity of insurance coverage and different protection necessities.

States typically don’t require medical cost protection for bikes. Medical funds protection, or MedPay, pays the medical bills of riders and their passengers that suffer accidents in motorbike accidents no matter who was at fault.

Nevertheless, for those who trip a bike in Michigan with out a helmet, it’s essential to have $20,000 in MedPay protection to adjust to the legislation. The protection is just not required for those who and your passenger put on helmets, however including it to a bike insurance coverage coverage may defend you towards monetary catastrophe brought on by the excessive value of medical therapy after a crash.

State-By-State Bike Insurance coverage Information

The next information provides you every state’s motorbike insurance coverage necessities. Remember the fact that most states have completely different necessities for bikes than for different varieties of motor automobiles.

For instance, Florida is a no-fault state, so drivers should have private damage safety (PIP) protection by way of an insurance coverage firm. An individual injured in a automotive accident submits their declare for cost of medical payments to PIP insurer as an alternative of creating a declare towards one other driver. Nevertheless, Florida doesn’t require PIP protection for bikes, so don’t assume {that a} state’s insurance coverage necessities for vehicles apply to bikes.

As you learn the information, legal responsibility insurance coverage necessities are proven as three numbers separated by slashes. For instance, 20/40/15 means a state requires bikes to have $20,000 in bodily damage protection per individual, $40,000 in bodily damage protection per accident for 2 or extra individuals, and $15,000 in property injury protection per accident.

Northeast Area

- Connecticut

- Is Bike Insurance coverage Required in Connecticut? Sure.

- Bike Insurance coverage Necessities in Connecticut: 25/50/25.

- Delaware

- Is Bike Insurance coverage Required in Delaware: Sure.

- Bike Insurance coverage Necessities in Delaware: 25/50/10.

- Private damage safety (PIP) required: $15,000 per individual and $30,000 most per accident.

- Maine

- Is Bike Insurance coverage Required in Maine? Sure.

- Bike Insurance coverage Necessities in Maine: 50/100/25.

- Massachusetts

- Is Bike Insurance coverage Required in Massachusetts? Sure.

- Bike Insurance coverage Necessities in Massachusetts: 20/40/5.

- New Hampshire

- Is Bike Insurance coverage Required in New Hampshire? No.

- Bike Insurance coverage Advisable in New Hampshire: 25/50/25.

- New Jersey

- Is Bike Insurance coverage Required in New Jersey? Sure.

- Bike Insurance coverage Necessities in New Jersey: 15/30/5.

- New York

- Is Bike Insurance coverage Required in New York? Sure.

- Bike Insurance coverage Necessities in New York: 25/50/10.

- Pennsylvania

- Is Bike Insurance coverage Required in Pennsylvania? Sure.

- Bike Insurance coverage Necessities In Pennsylvania: 15/30/5.

- Rhode Island

- Is Bike Insurance coverage Required in Rhode Island? Sure.

- Bike Insurance coverage Necessities in Rhode Island: 25/50/25.

- Vermont

- Is Bike Insurance coverage Required in Vermont? Sure.

- Bike Insurance coverage Necessities in Vermont: 25/50/10.

Midwest Area

- Illinois

- Is Bike Insurance coverage Required in Illinois? Sure.

- Bike Insurance coverage Necessities in Illinois: 25/50/20.

- Indiana

- Is Bike Insurance coverage Required in Indiana? Sure.

- Bike Insurance coverage Necessities in Indiana: 25/50/25.

- Iowa

- Is Bike Insurance coverage Required in Iowa? Sure.

- Bike Insurance coverage Necessities in Iowa: 25/40/15.

- Kansas

- Is Bike Insurance coverage Required in Kansas? Sure.

- Bike Insurance coverage Necessities in Kansas: 25/50/25.

- Michigan

- Is Bike Insurance coverage Required in Michigan? Sure.

- Bike Insurance coverage Necessities in Michigan: 50/100/10

- $20,000 medical advantages protection is required to trip with out a helmet.

- Minnesota

- Is Bike Insurance coverage Required in Minnesota? Sure.

- Bike Insurance coverage Necessities in Minnesota: 30/60/10.

- Missouri

- Is Bike Insurance coverage Required in Missouri? Sure.

- Bike Insurance coverage Necessities in Missouri: 25/50/10.

- Nebraska

- Is Bike Insurance coverage Required in Nebraska? Sure.

- Bike Insurance coverage Necessities in Nebraska: 25/50/25.

- North Dakota

- Is Bike Insurance coverage Required in North Dakota? Sure.

- Bike Insurance coverage Necessities in North Dakota: 25/50/25.

- Ohio

- Is Bike Insurance coverage Required in Ohio? Sure.

- Bike Insurance coverage Necessities in Ohio: 25/50/25.

- Oklahoma

- Is Bike Insurance coverage Required in Oklahoma? Sure.

- Bike Insurance coverage Necessities in Oklahoma: 25/50/25.

- South Dakota

- Is Bike Insurance coverage Required in South Dakota? Sure.

- Bike Insurance coverage Necessities in South Dakota: 25/50/25.

- Wisconsin

- Is Bike Insurance coverage Required in Wisconsin? Sure.

- Bike Insurance coverage Necessities in Wisconsin: 25/50/10.

South Area

- Alabama

- Is Bike Insurance coverage Required in Alabama? Sure.

- Bike Insurance coverage Necessities in Alabama: 25/50/25.

- Arkansas

- Is Bike Insurance coverage Required in Arkansas? Sure.

- Bike Insurance coverage Necessities in Arkansas: 25/50/25.

- Georgia

- Is Bike Insurance coverage Required in Georgia? Sure.

- Bike Insurance coverage Necessities in Georgia: 25/50/25.

- Florida

- Is Bike Insurance coverage Required in Florida? No.

- Bike Insurance coverage Necessities in Florida: None.

- 10/20/10 insurance coverage advisable to fulfill monetary duty.

- Kentucky

- Is Bike Insurance coverage Required in Kentucky? Sure.

- Bike Insurance coverage Necessities in Kentucky: 25/50/25.

- Louisiana

- Is Bike Insurance coverage Required in Louisiana? Sure.

- Bike Insurance coverage Necessities in Louisiana: 15/30/25.

- Maryland

- Is Bike Insurance coverage Required in Maryland? Sure.

- Bike Insurance coverage Necessities in Maryland: 30/60/15.

- Mississippi

- Is Bike Insurance coverage Required in Mississippi? Sure.

- Bike Insurance coverage Necessities in Mississippi: 25/50/10.

- North Carolina

- Is Bike Insurance coverage Required in North Carolina? Sure.

- Bike Insurance coverage Necessities in North Carolina: 25/50/25.

- South Carolina

- Is Bike Insurance coverage Required in South Carolina? Sure.

- Bike Insurance coverage Necessities in South Carolina: 25/50/25.

- Tennessee

- Is Bike Insurance coverage Required in Tennessee? Sure.

- Bike Insurance coverage Necessities in Tennessee: 25/50/15.

- Texas

- Is Bike Insurance coverage Required in Texas? Sure.

- Bike Insurance coverage Necessities in Texas: 30/60/25.

- Virginia

- Is Bike Insurance coverage Required in Virginia? Sure.

- Bike Insurance coverage Necessities in Virginia: 30/60/20.

- Washington, D.C.

- Is Bike Insurance coverage Required in Washington, D.C.? Sure.

- Bike Insurance coverage Necessities within the District of Columbia: 25/50/10.

- West Virginia

- Is Bike Insurance coverage Required in West Virginia? Sure.

- Bike Insurance coverage Necessities in West Virginia: 25/50/25.

Western Area

- Alaska

- Is Bike Insurance coverage Required in Alaska? Sure.

- Bike Insurance coverage Necessities in Alaska: 50/100/25.

- Arizona

- Is Bike Insurance coverage Required in Arizona? Sure.

- Bike Insurance coverage Necessities in Arizona: 25/50/15.

- California

- Is Bike Insurance coverage Required in California? Sure.

- Bike Insurance coverage Necessities in California: 15/30/5.

- Colorado

- Is Bike Insurance coverage Required in Colorado? Sure.

- Bike Insurance coverage Necessities in Colorado: 25/50/15.

- Hawaii

- Is Bike Insurance coverage Required in Hawaii? Sure.

- Bike Insurance coverage Necessities in Hawaii: 20/40/10.

- Idaho

- Is Bike Insurance coverage Required in Idaho? Sure.

- Bike Insurance coverage Necessities in Idaho: 25/50/15.

- Montana

- Is Bike Insurance coverage Required in Montana? No.

- Bike Insurance coverage Necessities in Montana: None required, however the state recommends 25/50/20.

- Nevada

- Is Bike Insurance coverage Required in Nevada? Sure.

- Bike Insurance coverage Necessities in Nevada: 25/50/20.

- New Mexico

- Is Bike Insurance coverage Required in New Mexico? Sure.

- Bike Insurance coverage Necessities in New Mexico: 25/50/10.

- Oregon

- Is Bike Insurance coverage Required in Oregon? Sure.

- Bike Insurance coverage Necessities in Oregon: 25/50/20.

- Utah

- Is Bike Insurance coverage Required in Utah? Sure.

- Bike Insurance coverage Necessities in Utah: 25/65/15.

- Washington

- Is Bike Insurance coverage Required in Washington? No.

- Bike Insurance coverage Necessities in Washington: None, however the state recommends 25/50/10.

- Wyoming

- Is Bike Insurance coverage Required in Wyoming? Sure.

- Bike Insurance coverage Necessities in Wyoming: 25/50/20.

Suggestions for Discovering The Finest Bike Insurance coverage

Now that you already know the motorbike insurance coverage necessities in your state, you need to discover the most effective insurance coverage in your cash. Listed below are a number of ideas to make use of to discover a coverage:

- Examine quotes: Getting quotes from a number of insurance coverage corporations is the one technique to know you’re getting the most effective deal.

- Evaluation protection choices: Rigorously evaluation quotes to make sure they’re for a similar protection and quantity of insurance coverage.

- Reductions and financial savings: Insuring your motorbike with the identical firm that insures your own home or automotive might prevent cash. You additionally save by growing deductibles, which is the cash you pay out-of-pocket once you file a declare. Some corporations supply reductions for veterans or senior residents.

- Customer support and popularity: Learn on-line evaluations of insurance coverage corporations to make sure the one you select has an excellent popularity for customer support. Right here is a wonderful supply to be taught how to decide on a bike insurance coverage insurance coverage coverage and firm.

Following the following tips can take the guesswork out of assembly the motorbike insurance coverage necessities of your state with out overpaying for the coverage.

Conclusion

Complying with state motorbike insurance coverage necessities is crucial to keep away from penalties which will embrace fines and license suspensions. It additionally provides you peace of thoughts understanding you’ve insurance coverage to pay claims made towards you after an accident.

If you’re injured in a bike crash, you possibly can get well compensation from the individual at fault for inflicting it. Defend your self by contacting the Bike Authorized Basis for a private damage legal professional able to aggressively preventing to get you the compensation you deserve. Contact the MLF right this moment for a session.

Want Bike Insurance coverage?

Take pleasure in your trip whereas feeling protected with the most effective insurance coverage protection.

[ad_2]