[ad_1]

If you happen to dwell in Arizona and your present bike insurance coverage coverage expires on or earlier than June 30, 2021, it’s possible you’ll discover a pointy improve in the fee to resume it. It is because the state elevated the minimal insurance coverage protection wanted to adjust to the legislation and keep away from a superb and license suspension for a violation.

It’s at all times a good suggestion to examine insurance coverage corporations and the charges they cost for bike insurance coverage, however a rise in necessary protection limits makes it much more vital now. Whether or not you favor purchasing for the most effective insurance coverage firm, the most cost effective charges, or a mixture of each, we need to make it simpler for you with well timed info that can assist you to make a wise and knowledgeable resolution.

COMPARE MOTORCYCLE INSURANCE

Examine free quotes from high suppliers.

Please reply the questions under:

Obligatory Motorbike Insurance coverage in Arizona

You have to adjust to state monetary duty legislation to function a motorcar, together with a motorbike, on public highways. Compliance requires that you simply present that you could pay claims made in opposition to you for bodily accidents, loss of life, or property injury ensuing from an accident that you simply brought about.

One methodology of complying with the legislation is by having a coverage of bike insurance coverage. Insurance policies issued or renewed on or earlier than June 30, 2020, want the next legal responsibility protection limits:

- $15,000 to pay claims for bodily harm or loss of life that you simply brought about to a different particular person by means of the operation of a motorbike.

- $30,000 protection for bodily accidents or loss of life brought about to 2 or extra folks in a single accident and topic to the boundaries obtainable for one particular person.

- $10,000 to pay for harm brought about to or destruction of property belonging to a different get together by means of the operation of a motorbike.

The necessary protection limits elevated for bike insurance coverage insurance policies issued or renewed on or after July 1, 2021, as follows:

- $25,000 to pay claims for bodily harm or loss of life that you simply brought about to a different particular person by means of the operation of a motorbike.

- $50,000 protection for bodily accidents or loss of life brought about to 2 or extra folks in a single accident and topic to the boundaries obtainable for one particular person.

- $15,000 to pay for harm brought about to or destruction of property belonging to a different get together by means of the operation of a motorbike.

Obligatory Protection Key Takeaways

- If you’re at fault for an accident that leads to the intense harm or loss of life of one other particular person, it’s seemingly that the damages will exceed your insurance coverage protection.

- Legal responsibility insurance coverage doesn’t pay for injury to property, or in your medical payments if you endure an harm in an accident.

- Until you buy extra protection above the necessary minimal, it’s possible you’ll be left with out compensation if the get together at fault doesn’t have insurance coverage protection.

Penalties for Using A Motorbike With out Insurance coverage

Driving a motorbike with out carrying no less than the minimal legal responsibility insurance coverage required by state legislation topics you to a two-stage course of that suspends or restricts your driving privileges and imposes hefty civil penalties as follows:

- First violation: After a courtroom imposes a civil penalty of no less than $500 for a primary violation of the legislation, the state has the fitting to droop or prohibit your driving privileges for so long as three months. The restrictions embody limiting you to solely driving at sure instances of the day or for particular functions, comparable to going to and from faculty or work.

- Second violation: The civil penalty will increase to $750, and the state suspension of driving privileges for six months consists of suspension of the registration and license plates of your bike for six months.

- Third and subsequent violation: Three or extra violations inside 36 months topic you to a $1,000 civil penalty and suspension of driving privileges, registration, and plates for one 12 months.

You could possibly keep away from or cut back the civil penalties for a violation of the insurance coverage legislation by bringing to courtroom a replica of your driving file exhibiting that you haven’t dedicated an analogous violation inside the previous 24 months or haven’t had multiple violation previously 36 months. You additionally should carry to the courtroom proof of buy of a six-month insurance coverage coverage that satisfies the minimal insurance coverage necessities.

Price of Motorbike Insurance coverage in Arizona

Reporting on the common value of insuring a automotive or bike presents a problem due to the totally different protection choices that may be added or omitted from a coverage to have an effect on its value. Different components that affect the value of insuring a car embody:

- Accidents and site visitors offenses improve the price of insurance coverage.

- The place you reside could improve what you pay for insurance coverage based mostly on theft and accident statistics.

- Younger drivers or ones who’re newly licensed usually pay extra for insurance coverage.

- Extra miles pushed will increase the chance of an accident and raises insurance coverage prices.

- Insurance coverage corporations usually cost extra to insure male than feminine drivers based mostly on accident statistics.

- Some varieties of bikes could have a better incidence of accidents than others.

- A low credit score rating could lead to an individual paying extra for insurance coverage.

The general claims paid by an insurance coverage firm have an effect on the insurance coverage charges it fees. You could have a clear driving file, however claims paid due to accidents and claims by different policyholders have an effect on what corporations cost for the insurance policies they write.

Motorbike Insurance coverage common value in Arizona

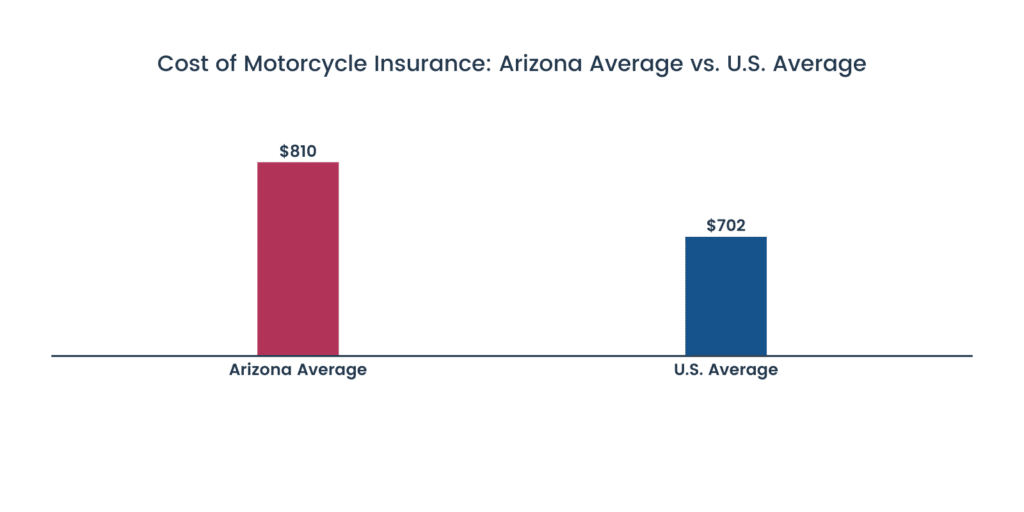

Data gathered from obtainable sources exhibits the common value to insure a motorbike in Arizona to be $810. The typical value within the state is greater than the nationwide common of $702. The averages are for insurance policies containing greater than the minimal bodily harm and property injury coverages required by state legislation.

Common Motorbike Insurance coverage Price By Age

All different driver variables being equal, your age performs a component in figuring out how a lot you pay for bike insurance coverage. A 25-year-old insuring a motorbike can anticipate to pay about $100 extra for a similar protection as a 55-year-old insuring the identical kind of bike in response to one supply.

Motorbike Insurance coverage Common by Area

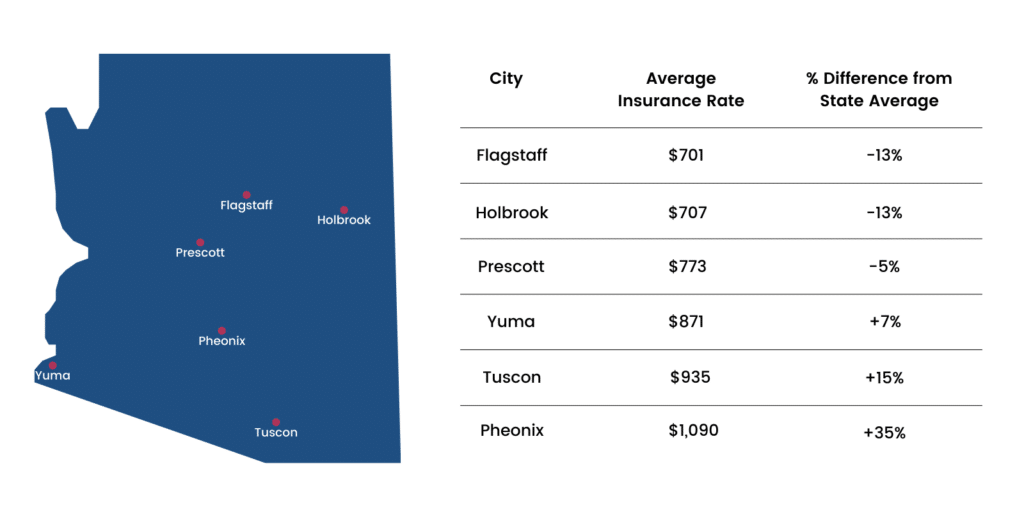

Age is just not the one variable affecting the price of bike insurance coverage. A take a look at charges all through Arizona exhibits a big distinction within the common value of insuring a motorbike relying upon the place you reside. For instance, when you dwell in Flagstaff, the common charge charged for insurance coverage is $701, which is 13% under the statewide common. Transferring to Mesa may considerably improve how a lot it prices to purchase insurance coverage in your bike as a result of the common charge is $1,110, which tops the statewide common by 27%.

The Most cost-effective Motorbike Insurance coverage in Arizona

Everybody has their very own cause for selecting a specific insurance coverage firm after they want bike insurance coverage. For some, it might be excellent customer support whereas others might want collision and complete protection that pays for unique gear producer or OEM components. Worth appears to be one factor all of them appear to agree on even when it isn’t the first cause for selecting a specific firm. It appears as if nobody needs to pay greater than they want to for bike insurance coverage.

Two corporations insuring bikes in Arizona stand out for his or her enchantment to the patrons in search of the most cost effective bike insurance coverage quote: Nationwide and Progressive. Nationwide had a median value for a coverage of $653 that beat the statewide common by a powerful 19%. Proper behind it was Progressive that beat the statewide common by 15% with a median coverage value of $686. If you’re in search of the most cost effective bike insurance coverage Arizona has to supply, both of those corporations deserves a glance.

The Finest Motorbike Insurance coverage in Arizona

All insurance coverage corporations make investments a large sum of cash into advertising and marketing to make themselves stand out from the pack. To decide on our picks for the most effective bike insurance coverage in Arizona, we determined to disregard the promoting and, as a substitute, deal with value or affordability, the protection choices provided, and the way they stack up in opposition to the competitors in offering persistently excellent service to their clients.

The Finest-rated Motorbike Insurers in Arizona

We relied on three extremely revered organizations, J.D. Energy, Nationwide Affiliation of Insurance coverage Commissioners, and A.M. Finest, to offer the knowledge to match bike insurance coverage corporations by way of customer support. The scores developed by the J.D. Energy examine of insurance coverage corporations providing insurance policies in Arizona, the grievance index compiled by NAIC, and the monetary power score from A.M. Finest offered the next outcomes:

| Compay | NAIC | J.D. Energy | A.M. Finest |

|---|---|---|---|

| Geico | 1.20 | 8/13 | A++ |

| State Farm | 0.57 | 3/13 | A++ |

| Progressive | 0.42 | 11/13 | A+ |

| USAA | 1.14 | 2/13 | A++ |

| Farmers | 0.30 | 10/13 | A |

| Allstate | 0.69 | 4/13 | A+ |

| American Household | 0.69 | 5/13 | A |

| Liberty Mutual | 1.18 | 9/13 | A |

| CSAA | 1.36 | 7/13 | A |

| Nationwide | 0.43 | 13/13 | A+ |

| Dairyland | 2.12 | — | A+ |

The score by NAIC displays complaints made relative to an organization’s share of the market. A 1.0 signifies that complaints had been in keeping with the market share. The J.D. Energy rank signifies the place an organization ranked in a survey of buyer opinion of 13 corporations. The score from A.M. Finest is an indicator of an organization’s means to fulfill its monetary commitments to its insureds.

Our Selections For The Finest Motorbike Insurance coverage Corporations in Arizona

You’ve many choices from which to decide on when the time involves buy bike insurance coverage. To assist together with your resolution, we offered quite a lot of info so that you can consider, and now consolidate it into our picks for the most effective bike insurance coverage in three separate classes:

- Progressive — Finest insurance coverage firm for most individuals: Successful high honors as the general finest bike insurance coverage in Arizona for many homeowners and riders is Progressive. It gives quite a lot of in style protection choices, together with cost for OEM components and endorsements offering protection for the customization that bike homeowners like so as to add. Its insurance policies are priced under the state common, and the corporate gives packages which will enable policyholders to obtain charge reductions.

- Nationwide – The most effective insurance coverage firm for affordability: In order for you the most cost effective bike insurance coverage in Arizona, Nationwide has it with common prices which can be 19% under the common for the state. The excellent news is that Nationwide gives rather more than simply cheap insurance coverage charges. It ranks proper up there with Progressive as being the most effective bike insurance coverage corporations providing insurance policies in Arizona with a big selection of protection choices.

- State Farm – The most effective insurance coverage firm for customer support: If customer support is vital to you when deciding on an organization for bike insurance coverage, State Farm with the third spot out of 13 within the J.D. Energy survey of buyer satisfaction would be the firm for you.

Earlier than selecting an organization to insure a motorbike, take a couple of minutes to checklist the protection you need and overview your funds to find out what you possibly can afford to spend. That info, together with all the things you realized about Arizona bike insurance coverage from what we provided, makes you a wise and knowledgeable shopper.

Tricks to Select the Finest Motorbike Insurance coverage in Arizona

Worth Penguin evaluated over 250 gives in three classes to find out the most effective automotive insurance coverage firm in Arizona. The most effective bike insurance coverage corporations share three traits:

- Inexpensive: The value you possibly can anticipate to pay for a typical Arizona bike insurance coverage purchaser.

- Protection possibility: Learn how to examine protection offered by one firm with one other.

- Buyer Service: Does the insurance coverage firm persistently meet the wants of policyholders?

Your bike insurance coverage needs to be inexpensive sufficient that you could contemplate buying extra compensation when you select so. However even with out dietary supplements, the coverage should present satisfactory protection with out buying add-ons. Your bike insurance coverage must also be capable to meet the wants of its policyholders and reply pretty to claims.

Have You Been Concerned In A Motorbike Accident?

Our skilled authorized staff screens submissions and assigns circumstances to a few of the finest bike legal professionals within the US.

[ad_2]