[ad_1]

The U.S. Treasury Division on Friday introduced an replace on how autos will qualify as a automobile or an SUV underneath the revamped EV tax credit score, now often called the clear car tax credit score.

For EV customers it’s excellent news, as it is going to clear up a complicated and seemingly arbitrary dividing line by which some variations of sure fashions—just like the Tesla Mannequin Y—had been made eligible at the next MSRP whereas others weren’t.

The brand new credit score set underneath the Inflation Restoration Act incorporates a variety of modifications, together with earnings caps, in addition to home sourcing guidelines not but enforced. Nevertheless it additionally units value caps for qualifying EVs, of $55,000 for brand new vehicles and $80,000 for pickup vehicles, SUVs, and vans; and up to now that’s been one of the fraught for customers.

2023 Volkswagen ID.4

Merely put, some fashions categorised as SUVs on their window stickers had been being restricted to the $55,000 cap.

What modifications: Have a look at the window sticker

To make it simpler for shoppers to know which autos qualify underneath the relevant MSRP cap, Treasury is updating the car classification customary to make use of the consumer-facing EPA Gas Economic system Labeling customary, moderately than the CAFE (company common gasoline economic system) customary.

“This modification will enable crossover autos that share related options to be handled persistently,” acknowledged the Treasury Division,” in a launch. “It can additionally align car classifications underneath the clear car credit score with the classification displayed on the car label and on the consumer-facing web site FuelEconomy.gov.”

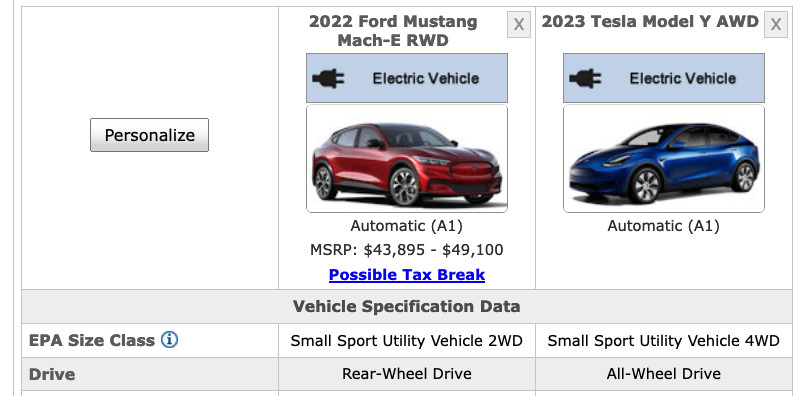

Ford Mustang Mach-E and Tesla Mannequin Y instance for EPA class

Buyers can discover the EPA classification of a car at FuelEconomy.gov, and clicking the “Specs” tab. As an illustration, the Tesla Mannequin Y and Ford Mustang Mach-E lineups are each categorised as “Small Sport Utility Automobile” by the EPA—making clear that they’d now be eligible.

And to underscore this, the IRS had already, on Friday morning, up to date its listing of qualifying autos and their respective value caps.

How this occurred

For the sake of readability, it’s a very good transfer. So how did this occur within the first place?

The Treasury Division determined to make use of the definition between automobile and SUV with historic priority. Underneath that, SUVs with a gross car weight underneath 6,000 kilos are lumped with vehicles provided that they’ve four-wheel drive (or all-wheel drive).

It dates again to the Nineteen Seventies—nicely earlier than SUVs had been any vital market classification of passenger autos—and it hasn’t been up to date considerably since then.

This regulatory distinction between vehicles and SUVs is simply presently used to calculate company common fleet gasoline economic system (CAFE)—a compliance obligation, and a gauge by regulators on how nicely the business is doing in maintaining on effectivity and emissions requirements. However the listing of autos that issue into CAFE as vehicles or vehicles and why isn’t laid out anyplace clearly anyplace in a kind shoppers can perceive.

2022 Ford Mustang Mach-E

Additional, the applying of the CAFE distinction between vehicles and SUVs doesn’t present a lot of a helpful distinction between car varieties and the way they may truly be shopped or used.

So using it for the EV tax credit score basically threw down a dividing line down in the midst of the SUV area, penalizing lighter fashions with two-wheel drive, whereas rewarding heavier fashions with all-wheel drive, extra seats, and maybe efficiency choices.

Sure, it’s retroactive—to January 1

The Treasury Division says that those that positioned a car in service (took supply) since January 1, 2023, that qualifies underneath the brand new definition and fulfill all the opposite credit score necessities will be capable of declare it—even when the autos didn’t qualify up till in the present day.

Now that now we have readability on car varieties qualifying for sure value caps, the Treasury notes that one other replace is coming. Steerage on U.S. sourcing for essential minerals—an space of the tax credit score not but being enforced—is because of be issued in March, and it’s prone to slender the sector considerably for EVs that qualify for the complete credit score.

[ad_2]