[ad_1]

It has been a while because you parted methods with ACEA and so did the Stellantis. There’s a widespread pitch within the two OEM in your declare that the affiliation was not defending your pursuits. Is it expectable that the 2 producers will be a part of efforts to create an organisation you are feeling defends your pursuits?

Jim Rowan- After we left ACEA it was as a result of we wished to go in a single route and we didn’t really feel they have been pushing in the identical method: merely put, we wish to be totally electrical by 2030 and ACEA is aiming for 2035 and this suggests completely different steps in several moments. There was no fallout, we’re nonetheless out there to cooperate in particular points we predict make sense for the entire business like cost infrastructure and sure requirements, as an illustration. However now we have no intention to arrange one other parallel affiliation at this cut-off date.

Though you’ve gotten not too long ago proven some concern about how gradual your rivals are adopting the mandatory measures for the electrical conversion? And now additionally the legislators exhibiting some willingness to simply accept slowing down the method?

JR- Though now we have a sooner tempo in direction of full electrical, a few of these corporations are already producing EV and you then take a look at issues as charging requirements and it makes absolute sense for all of us to get on the identical boat for the widespread curiosity (each of the business and the shoppers). There isn’t a sense in setting completely different charging networks whether or not it’s DCS or Ionity. We had an settlement with Tesla, within the USA, to make use of their chargers and I consider that must be an instance to observe in Europe and different areas as nicely.

Do you see a special velocity in transformation between the Chinese language within the business and the European in direction of electrification?

JR- Whenever you take a look at the method from a worldwide perspective, certainly we see three completely different footage. Within the USA now we have the West Coast (largely but in addition the East) electrifying at an excellent tempo fomented by the Inflation Discount Act (which I applaud for selling Inexperienced Power and general local weather safety measures). The inside is falling behind, even when will probably be helped by Electrify America effort. In Europe, the north can be transferring quick, southern Europe is slower. In each instances it is a bonus for Volvo which gives PHEV and MHEV automobiles versus a pure EV participant which can not get a grasp of the entire market now. And China, though its greater, can be doing an enormous effort which comes from the half that the a whole lot of big cities play on this course of.

You’ve introduced the final diesel engine can be produced in early 2024… what about PHEV… are you not investing in them anymore?

JR- We now solely have testing services in our R&D centres globally however we aren’t investing on that expertise. We did what we might within the XC60 PHEV/XC90 PHEV to supply extra vary, utilizing the identical area and platform structure however including vary with a battery with greater vitality density and likewise improved energy electronics.

It´s an ungainly concept that in six years you’ll solely assemble electrical vehicles…

JR- Not likely. The corporate that’s primary in EV gross sales globally has been doing this for years and so they promote a number of vehicles. It´s not like we’re going to step on skinny ice once we get there. They’re the market leaders by way of gross sales and essentially the most profitable automotive producer by way of market capitalization by far. So that’s the proof level you could be a purely electrical automotive model already as we speak and be extremely profitable.

MPVs have come and gone however now you shock the world with an electrical MPV. Might it work in markets outdoors China the place you’ve gotten developed and the place you’re launching it?

JR- We don’t know precisely if the demand can be there in some years in different areas. 20 years in the past nobody anticipated how profitable SUV have been going to be. In China it does make sense as a result of there’s a number of intergenerational actions happening throughout weekends: you get the mom, the daddy, the grandparents, the children, all going someplace and on the lookout for consolation and a premium journey expertise. So there we’re with the EM90 which performs completely into our security narrative.

You may be near 700 000 items gross sales in 2023 which is able to technically match your all-time highest gross sales quantity (in 2019, 705 000). You’ll add the EX90 and the EX30 within the subsequent months… does that imply a million new Volvo on the highway in a single yr is simply across the nook?

JR- On the IPO we mentioned we’d be at round 1.2 million/yr by mid-decade and we’re nicely on observe. We’ve been very choiceful in the way in which we’re electrifying our portfolio and that’s serving to us. Individuals want a compact SUV like within the EX30 and in that section a 480 km vary is completely tremendous… and even lower than that if you will use cheaper LFP batteries to decrease the car value. That was some white area to open up and usher in new clients and new gross sales. Similar factor in regards to the EX90 relating to new clients coming in.

All people is weary in regards to the challenges the EV technique adoption brings. Are you able to sheer everybody up with a extra optimistic view about a very powerful automotive revolution in 100 years?

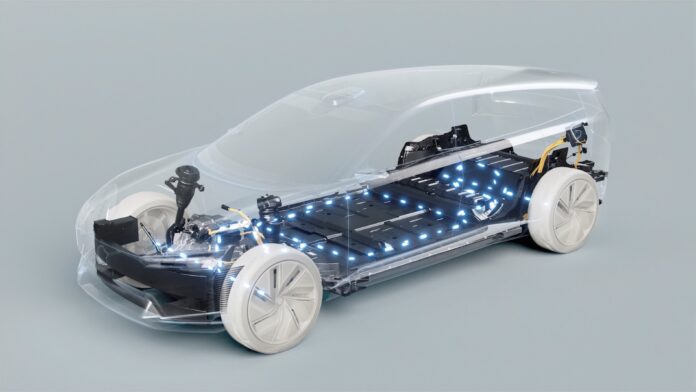

JR- Here’s a factor that by no means will get spoken about. I come from a special background, not automotive. I’m from the tech sector, I’m manufacturing engineer and I did my masters in Provide Chain. Whenever you construct ICE vehicles you’ve gotten enormous complexity… you’ve gotten a 1.2, a 1.6. a 2 litre engine, 4 cylinders, 6 cylinders… all of the pistons have completely different sizes, all of the piston rings, all of the cylinders and cylinder heads and blocks… screws, nuts, bolts… every part is a special measurement. Whenever you transfer to electrical motors it’s a very completely different state of affairs… a very completely different provide chain. An e-motor (perhaps in two sizes) and a battery after which to get completely different outputs for various car segments you simply add extra modules or scale back them, you get torque “at no cost”. And that’s it.

So there is no such thing as a motive why the value parity between ICE and EV must be pushed ahead by way of the calendar?

JR- We’re there. Even within the case of our smaller automotive, in a extra value delicate section: the EX30. We’ve said that we’ll promote it for 35 000 {dollars} and we heard feedback that we have been crushing our revenue margins, however that’s not true. Most OEM are very secretive about their BEV and ICE margins, however we have been completely clear. Value of lithium could change the equation right here and there, however we’re at 9 p.c BEV margin as we speak and can enhance it to fifteen to twenty p.c with the EX30. That´s not lower than ICE margins, I guarantee you.

Are you able to show it?

JR- That´s the identical query we get from the markets. I inform you one factor: in seven months, once we current our Q2 outcomes from 2024, you will notice what number of EX30 we offered and it is possible for you to to verify what the car´s revenue margin is. We would be the solely guys near the Tesla figures in that respect. After which we’ll show that we have been one the primary among the many heritage corporations which have crossed the Rubicon and obtained to the opposite facet with first rate EV gross sales volumes and first rate revenue margins.

[ad_2]