[ad_1]

The US Treasury division introduced it can delay its steerage in regard to the sourcing necessities for battery supplies to ensure that EVs to qualify for federal tax credit. Starting January 1, 2023, a slew of recent necessities will nonetheless take have an effect on, however the lack of battery tips may supply a quick window in 2023 the place electrical automobile purchases that won’t match the pending battery sourcing necessities nonetheless qualify for some degree of tax credit.

In late July 2022, the US Senate shared it was shifting ahead to vote on EV tax credit score reform and some of the outstanding elements of the invoice included the long-awaited and fought-over electrical automobile tax credit score reform.

On August 7, 2022 the Inflation Discount Act was permitted by the Senate and per week later signed into regulation by President Biden. From the very begin, the largest concern most of us have had with the Inflation Discount Act, has been deciphering its revised necessities to ensure that a given EV to qualify for tax credit.

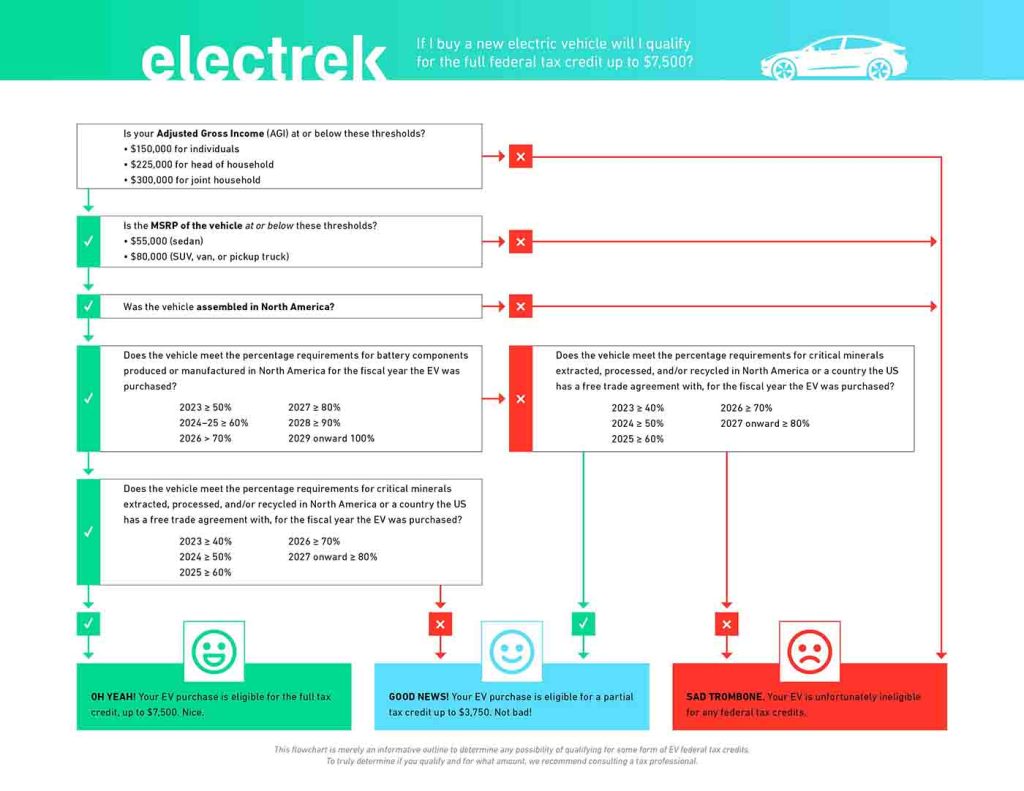

We’ve damaged it down step-by-step in right here, however right here’s are the important thing factors relative to in the present day’s information:

- $7,500 credit score is damaged into two binary items that means the automobile both qualifies for every bit of the credit score or it doesn’t.

- $3,750 of the brand new credit score is predicated upon the automobile having at the very least 40% of its battery important minerals from the USA or international locations with a free commerce settlement with the USA. It is a checklist of nations with free commerce agreements with the US.

- The opposite $3,750 of the brand new credit score is predicated on at the very least 50% of the battery parts of the automobile coming from the USA or international locations with a free commerce settlement with the US.

- The federal government has till the top of the yr to develop steerage on the battery necessities.

Did you catch that final line? That’s price noting as a result of the US Treasury Division has now come out and shared that it wants till at the very least March to find out the EV battery necessities, regardless of different tax credit score necessities outlined within the Inflation Discount Act kicking in lower than two weeks from now.

Some EVs might qualify for tax credit by way of March 2023

As reported by Reuters, the US Treasury Division has delayed its battery steerage for qualifying EV tax credit till someday in March. Nonetheless, necessities like North American meeting of the EV in addition to caps on MSRP and annual wage will nonetheless go into impact on January 1 as deliberate.

Nevertheless, for the reason that US authorities is unable to offer steerage on the battery necessities, there’s a chance that some EVs offered between January 1 and “someday in March” that can inevitably not adjust to the pending battery steerage might briefly nonetheless qualify for federal tax credit.

This might come as welcomed information for customers and automakers alike, since a considerably smaller checklist of EVs will qualify for tax credit when the revised phrases start within the new yr. Automakers have begun shifting their manufacturing to North America with the intention to as soon as once more qualify, however that enormous of a transition can take years.

The US Treasury mentioned it can “launch info on the anticipated route” of its battery steerage by December 31. Moreover, “the important mineral and battery part necessities take impact solely after Treasury points that proposed rule.”

This story is ongoing and we’re positive to get a bit extra readability earlier than the ball drops on 2022, however just a few further months with out stringent battery guidelines may benefit customers wanting to economize on a brand new EV because of federal tax credit, particularly with automakers like Tesla and GM as soon as once more qualifying.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.

[ad_2]